Recommended Software

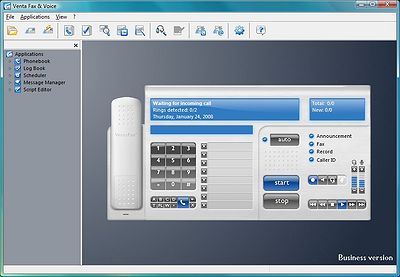

VentaFax Business 6.0

VentaFax is a full-featured fax and answering machine software with color fax support. It sends and receives faxes and turns your PC with a fax modem into a versatile answering machine with remote control and email integration. You can retrieve your fax and voice messages from any touchtone phone...

DOWNLOADSoftware Catalog

Android Android |

Business & Productivity Tools Business & Productivity Tools |

Desktop Desktop |

Developer Tools Developer Tools |

Drivers Drivers |

Education Education |

Games Games |

Home & Personal Home & Personal |

Internet & Networking Internet & Networking |

Multimedia & Design Multimedia & Design |

Operating Systems Operating Systems |

Utilities Utilities |

WebCab Options (J2SE Edition)

WebCab Options (J2SE Edition) 2.5

Category:

Business & Productivity Tools / Finance & Accounting

| Author: WebCab Components

DOWNLOAD

GET FULL VER

Cost: $159.00 USD

License: Demo

Size: 9.2 MB

Download Counter: 20

This product also contains the following features:

* GUI Bundle - we bundle a suite of graphical user interface JavaBean components (with 1, 2, 4 or site-wide license) allowing the developer to plug-in a wide range of GUI functionality (including charts/graphs) into their client applications

* EAR Files - we provide individual customized EAR files for the most widely used application servers including IBM WebSphere 4.0/5.0, BEA WebLogic 6.1/7.0, Oracle 9iAS, Sun ONE AppServer 7, Ironflare Orion 1.5.2/1.6.0, Borland AppServer 5.0, Sybase EAServer 3.6 and JBoss 2.4.4/3.0.0

* Self-Deploy - the relevant servers EAR file will be self-deployed onto supported local application servers during the installation of the self-install package. The supported application servers include IBM WebSphere 4.0/5.0, BEA WebLogic 6.1/7.0, Oracle 9iAS, Borland AppServer 5.0, Ironflare Orion 1.5.2/1.6.0 and JBoss 2.4.4/3.0.0

Requirements: An Operating System running Java

OS Support:

Language Support:

Related Software

American | Asian | Bermuda Poker | Binary | Class Libraries | Dwg java class | European Business | Finite Difference | Finite Element | Free javabeans | Futures | J2se | Java | Java J2se | Jsp | Mac futures | Monte Carlo | Mp3 java class | Options

WebCab Options (J2EE Edition) - EJB suite including price option and futures contracts using Monte Carlo and Finite Difference techniques. General MC pricing framework: wide range of contracts, price, interest and vol models.

WebCab Options (J2EE Edition) - EJB suite including price option and futures contracts using Monte Carlo and Finite Difference techniques. General MC pricing framework: wide range of contracts, price, interest and vol models. WebCab Options and Futures for .NET - 3-in-1: .NET, COM and XML Web service Components for pricing option and futures contracts using Monte Carlo and Finite Difference techniques. General MC pricing framework included: wide range of contracts, price, interest and vol models.

WebCab Options and Futures for .NET - 3-in-1: .NET, COM and XML Web service Components for pricing option and futures contracts using Monte Carlo and Finite Difference techniques. General MC pricing framework included: wide range of contracts, price, interest and vol models. WebCab Options and Futures for Delphi - 3-in-1: .NET, COM and XML Web service Components for pricing option and futures contracts using Monte Carlo and Finite Difference techniques. General MC pricing framework included: wide range of contracts, price, interest and vol models.

WebCab Options and Futures for Delphi - 3-in-1: .NET, COM and XML Web service Components for pricing option and futures contracts using Monte Carlo and Finite Difference techniques. General MC pricing framework included: wide range of contracts, price, interest and vol models. WebCab Bonds (J2SE Edition) - Java API to model the pricing and risk analytics of interest rate cash and derivative products. We cover the fundamental theory of bonds including: Treasury bonds, Yield/Pricing, Zero Curve, Forward rates/FRAs, Duration and Convexity....

WebCab Bonds (J2SE Edition) - Java API to model the pricing and risk analytics of interest rate cash and derivative products. We cover the fundamental theory of bonds including: Treasury bonds, Yield/Pricing, Zero Curve, Forward rates/FRAs, Duration and Convexity.... WebCab Bonds for .NET - 3-in-1: COM, .NET and XML Web service Interest derivatives pricing framework: set contract, set vol/price/interest models and run MC. We also cover: Treasury's, Price/Yield, Zero Curve, Fixed-Interest bonds, Forward rates/FRAs, Duration and Convexity

WebCab Bonds for .NET - 3-in-1: COM, .NET and XML Web service Interest derivatives pricing framework: set contract, set vol/price/interest models and run MC. We also cover: Treasury's, Price/Yield, Zero Curve, Fixed-Interest bonds, Forward rates/FRAs, Duration and Convexity WebCab Bonds for Delphi - 3-in-1: COM, .NET and XML Web service Interest derivatives pricing framework: set contract, set vol/price/interest models and run MC. We also cover: Treasury's, Price/Yield, Zero Curve, Fixed-Interest bonds, Forward rates/FRAs, Duration and Convexity

WebCab Bonds for Delphi - 3-in-1: COM, .NET and XML Web service Interest derivatives pricing framework: set contract, set vol/price/interest models and run MC. We also cover: Treasury's, Price/Yield, Zero Curve, Fixed-Interest bonds, Forward rates/FRAs, Duration and Convexity IDAutomation Java Barcode Package - This barcode package contains JavaBeans, Applets, Class Libraries and Servlets for Barcoding in Java. Supports Linear and 2D barcode types including Code 128, Code 39, ITF, UPC, EAN, OneCode, DataMatrix, Maxicode and PDF417.

IDAutomation Java Barcode Package - This barcode package contains JavaBeans, Applets, Class Libraries and Servlets for Barcoding in Java. Supports Linear and 2D barcode types including Code 128, Code 39, ITF, UPC, EAN, OneCode, DataMatrix, Maxicode and PDF417. WebCab Functions (J2SE Edition) - This Java class library offers refined numerical procedures to either construct a function of one or two variables from a set of points (i.e. interpolate), or solve an equation of one variable.

WebCab Functions (J2SE Edition) - This Java class library offers refined numerical procedures to either construct a function of one or two variables from a set of points (i.e. interpolate), or solve an equation of one variable. Excel VBA Models Combo Set - The Excel VBA Models Open Source Code Combo Set contains 37 programs in finance, statistics, option pricing models, and numerical methods in open source code. Programs include Distribution 12 Random Number Generator, 6 Option Pricing Models & more..

Excel VBA Models Combo Set - The Excel VBA Models Open Source Code Combo Set contains 37 programs in finance, statistics, option pricing models, and numerical methods in open source code. Programs include Distribution 12 Random Number Generator, 6 Option Pricing Models & more.. Project Risk Analysis - Use Monte Carlo Simulation to determine the risk of a project being overspent and the contingency needed to achieve the desired level of confidence.

Project Risk Analysis - Use Monte Carlo Simulation to determine the risk of a project being overspent and the contingency needed to achieve the desired level of confidence.

Top Downloads

Top Downloads

- PayWindow Payroll System

- Excel Invoice Template

- LIbro di cassa

- Alfa2000

- Forex Strategy Builder

- MobFolio

- Project Management

- Calculate My Loan

- Gestionale XP

- AcQuest 941 Solution 2007

New Downloads

New Downloads

- PayWindow Payroll System

- Project Management

- TimeLive

- Rylstim Budget

- Merops

- Billing Software

- DTA-Ueberweisung

- Invoice Manager

- Purchase Order

- Xin Invoice

New Reviews

- jZip Review

- License4J Review

- USB Secure Review

- iTestBot Review

- AbsoluteTelnet Telnet / SSH Client Review

- conaito VoIP SDK ActiveX Review

- conaito PPT2SWF SDK Review

- FastPictureViewer Review

- Ashkon MP3 Tag Editor Review

- Video Mobile Converter Review

Actual Software

| Link To Us

| Links

| Contact

Must Have

| TOP 100

| Authors

| Reviews

| RSS

| Submit