Recommended Software

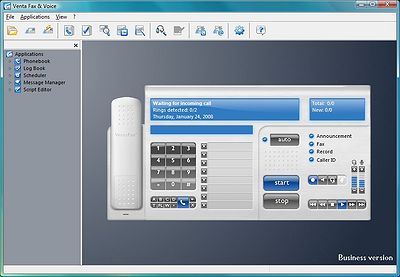

VentaFax Business 6.0

VentaFax is a full-featured fax and answering machine software with color fax support. It sends and receives faxes and turns your PC with a fax modem into a versatile answering machine with remote control and email integration. You can retrieve your fax and voice messages from any touchtone phone...

DOWNLOADSoftware Catalog

Android Android |

Business & Productivity Tools Business & Productivity Tools |

Desktop Desktop |

Developer Tools Developer Tools |

Drivers Drivers |

Education Education |

Games Games |

Home & Personal Home & Personal |

Internet & Networking Internet & Networking |

Multimedia & Design Multimedia & Design |

Operating Systems Operating Systems |

Utilities Utilities |

WebCab Options and Futures for Delphi Feedback System

WebCab Options and Futures for Delphi Info

License: Demo | Author: WebCab Components | Requirements: .NET Framework v1.x

3-in-1: .NET, COM and XML Web service Components for pricing option and futures contracts using Monte Carlo and Finite Difference techniques. General Monte Carlo pricing framework: wide range of contracts, price, interest and vol models. Price European, Asian, American, Lookback, Bermuda and Binary Options using Analytic, Monte Carlo and Finite Difference in accordance with a number of vol, price, volatility and rate models.

General Pricing Framework offers the following predefined Models and Contracts:

Contracts: Asian Option, Binary Option, Cap, Coupon Bond, Floor, Forward Start stock option, Lookback Option, Ladder Option, Vanilla Swap, Vanilla Stock Option, Zero Coupon Bond, Barrier Option, Parisian Option, Parasian Option, Forward and Future.

Interest Rate Models: Constant Spot Rate, Constant (in time) Yield curve, One factor stochastic models (Vasicek, Black-Derman-Toy (BDT), Ho & Lee, Hull and White), Two factor stochastic models (Breman & Schwartz, Fong & Vasicek, Longstaff & Schwartz), Cox-Ingersoll-Ross Equilibrium model, Spot rate model with automatic yield (Ho & Lee, Hull & White), Heath-Jarrow-Morton forward rate model, Brace-Gatarek-Musiela (BGM) LIBOR market model.

Price Models: Constant price model, General deterministic price model, Lognormal price model, Poisson price model.

Volatility Models: Constant Volatility Models, General Deterministic Volatility model, Hull & White Stochastic model of the Variance, Hoston Stochastic Volatility model.

Monte Carlo Princing Engine: Evaluate price estimate accordance to number of iterations or maximum expected error. Evaluate the standard deviation of the price estimate, and the minimum/maximum expected price for a given confidence level.

This product also has the following technology aspects:

3-in-1: .NET, COM, and XML Web services - 3 DLLs, 3 API Docs,...

Extensive Client Examples (Delphi for .NET, C#, VB.NET)

ADO Mediator

Compatible Containers (Delphi 3-8, Delphi 2005, C++Builder

WebCab Components Software

WebCab Bonds (J2EE Edition) - EJB Suite offering general Interest derivatives pricing framework: set contract and vol/price/interest models and run MC. Also Analyze Treasury bonds, Yield, Zero Curve, FRAs, Duration/Convexity.

WebCab Bonds (J2EE Edition) - EJB Suite offering general Interest derivatives pricing framework: set contract and vol/price/interest models and run MC. Also Analyze Treasury bonds, Yield, Zero Curve, FRAs, Duration/Convexity. WebCab Bonds (J2SE Edition) - Java API to model the pricing and risk analytics of interest rate cash and derivative products. We cover the fundamental theory of bonds including: Treasury bonds, Yield/Pricing, Zero Curve, Forward rates/FRAs, Duration and Convexity....

WebCab Bonds (J2SE Edition) - Java API to model the pricing and risk analytics of interest rate cash and derivative products. We cover the fundamental theory of bonds including: Treasury bonds, Yield/Pricing, Zero Curve, Forward rates/FRAs, Duration and Convexity.... WebCab Bonds for .NET - 3-in-1: COM, .NET and XML Web service Interest derivatives pricing framework: set contract, set vol/price/interest models and run MC. We also cover: Treasury's, Price/Yield, Zero Curve, Fixed-Interest bonds, Forward rates/FRAs, Duration and Convexity

WebCab Bonds for .NET - 3-in-1: COM, .NET and XML Web service Interest derivatives pricing framework: set contract, set vol/price/interest models and run MC. We also cover: Treasury's, Price/Yield, Zero Curve, Fixed-Interest bonds, Forward rates/FRAs, Duration and Convexity WebCab Bonds for Delphi - 3-in-1: COM, .NET and XML Web service Interest derivatives pricing framework: set contract, set vol/price/interest models and run MC. We also cover: Treasury's, Price/Yield, Zero Curve, Fixed-Interest bonds, Forward rates/FRAs, Duration and Convexity

WebCab Bonds for Delphi - 3-in-1: COM, .NET and XML Web service Interest derivatives pricing framework: set contract, set vol/price/interest models and run MC. We also cover: Treasury's, Price/Yield, Zero Curve, Fixed-Interest bonds, Forward rates/FRAs, Duration and Convexity WebCab Functions (J2EE Edition) - This EJB Suite offers refined numerical procedures to either construct a function of one or two variables from a set of points (i.e. interpolate), or solve an equation of one variable.

WebCab Functions (J2EE Edition) - This EJB Suite offers refined numerical procedures to either construct a function of one or two variables from a set of points (i.e. interpolate), or solve an equation of one variable. WebCab Functions (J2SE Edition) - This Java class library offers refined numerical procedures to either construct a function of one or two variables from a set of points (i.e. interpolate), or solve an equation of one variable.

WebCab Functions (J2SE Edition) - This Java class library offers refined numerical procedures to either construct a function of one or two variables from a set of points (i.e. interpolate), or solve an equation of one variable. WebCab Functions for .NET - Add refined numerical procedures to either construct a function of one or two variables from a set of points (i.e. interpolate), or solve an equation of one variable; to your .NET, COM and XML Web service Applications.

WebCab Functions for .NET - Add refined numerical procedures to either construct a function of one or two variables from a set of points (i.e. interpolate), or solve an equation of one variable; to your .NET, COM and XML Web service Applications. WebCab Functions for Delphi - Add refined numerical procedures to either construct a function of one or two variables from a set of points (i.e. interpolate), or solve an equation of one variable; to your .NET, COM and XML Web service Applications. Delphi 3-8 & 2005 are supported

WebCab Functions for Delphi - Add refined numerical procedures to either construct a function of one or two variables from a set of points (i.e. interpolate), or solve an equation of one variable; to your .NET, COM and XML Web service Applications. Delphi 3-8 & 2005 are supported WebCab Optimization (J2EE Edition) - EJB collection containing refined procedures for solving sensitivity analysis on uni and multi dimensional, local or global optimization problems. Specialized Linear programming algorithms based on the Simplex Algorithm and duality, are included.

WebCab Optimization (J2EE Edition) - EJB collection containing refined procedures for solving sensitivity analysis on uni and multi dimensional, local or global optimization problems. Specialized Linear programming algorithms based on the Simplex Algorithm and duality, are included. WebCab Optimization (J2SE Edition) - Java API containing refined procedures for solving sensitivity analysis on uni and multi dimensional, local or global optimization problems. Specialized Linear programming algorithms based on the Simplex Algorithm and duality, are included.

WebCab Optimization (J2SE Edition) - Java API containing refined procedures for solving sensitivity analysis on uni and multi dimensional, local or global optimization problems. Specialized Linear programming algorithms based on the Simplex Algorithm and duality, are included.

Top Downloads

Top Downloads

- PayWindow Payroll System

- Excel Invoice Template

- LIbro di cassa

- Alfa2000

- Forex Strategy Builder

- MobFolio

- Project Management

- Calculate My Loan

- Gestionale XP

- AcQuest 941 Solution 2007

New Downloads

New Downloads

- PayWindow Payroll System

- Project Management

- TimeLive

- Rylstim Budget

- Merops

- Billing Software

- DTA-Ueberweisung

- Invoice Manager

- Purchase Order

- Xin Invoice

New Reviews

- jZip Review

- License4J Review

- USB Secure Review

- iTestBot Review

- AbsoluteTelnet Telnet / SSH Client Review

- conaito VoIP SDK ActiveX Review

- conaito PPT2SWF SDK Review

- FastPictureViewer Review

- Ashkon MP3 Tag Editor Review

- Video Mobile Converter Review

Actual Software

| Link To Us

| Links

| Contact

Must Have

| TOP 100

| Authors

| Reviews

| RSS

| Submit